Understanding the 2025 Social Security COLA Increase

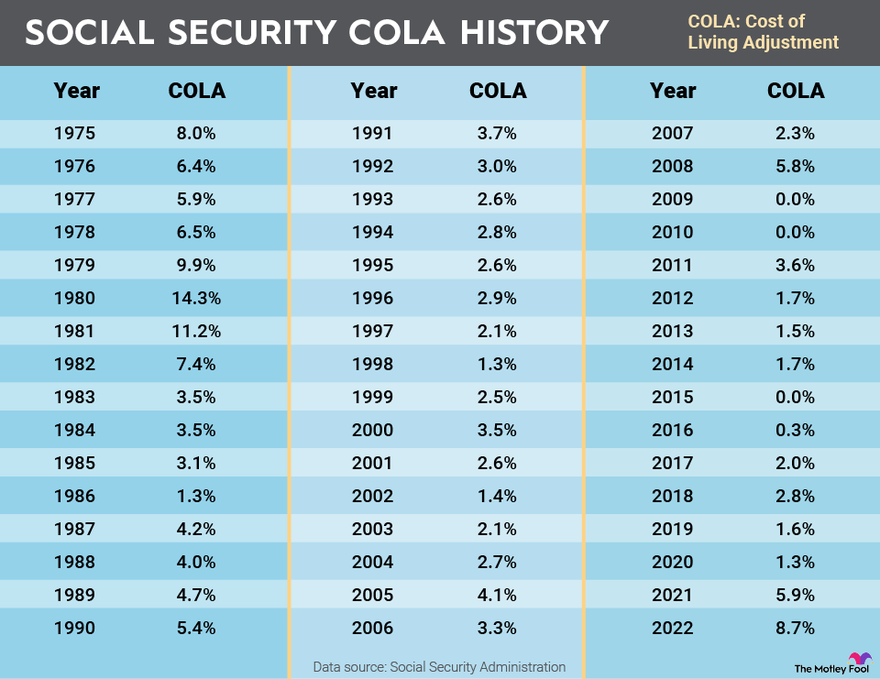

The Social Security Cost-of-Living Adjustment (COLA) is an annual increase in benefits paid to Social Security recipients to help offset the effects of inflation. The COLA is calculated using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures the average change in prices paid by urban consumers for a basket of goods and services.

The COLA is determined by comparing the CPI-W from the third quarter of the current year to the third quarter of the previous year. The percentage change in the CPI-W over that period represents the COLA increase.

Projected Inflation Rate and its Impact on COLA, 2025 social security cola increase

The projected inflation rate for 2025 is currently estimated at around 3%. This means that the COLA increase for 2025 is expected to be approximately 3%.

A 3% COLA increase would mean that Social Security recipients would receive an additional 3% on top of their current benefits. For example, a recipient who currently receives $1,500 per month would see their monthly benefit increase to $1,545.

Potential Benefits and Challenges of the Projected COLA Increase

The projected COLA increase for 2025 could provide some relief to Social Security recipients who are struggling to keep up with rising costs. However, the increase may not be enough to fully offset the impact of inflation for all recipients.

The COLA increase is designed to help Social Security recipients maintain their purchasing power, but it does not guarantee that they will be able to keep up with the rising cost of living.

Benefits of the COLA Increase

- Increased purchasing power: The COLA increase will help Social Security recipients maintain their purchasing power by offsetting the effects of inflation.

- Improved standard of living: The increase could help recipients afford basic necessities, such as food, housing, and healthcare.

- Reduced financial stress: The COLA increase could help recipients reduce financial stress and improve their overall well-being.

Challenges of the COLA Increase

- Inflation may outpace COLA: The rate of inflation could exceed the COLA increase, leaving recipients with less purchasing power than they had before.

- Limited impact on lower-income recipients: The COLA increase may have a limited impact on lower-income recipients, who may be struggling to make ends meet even with the increase.

- Sustainability of Social Security: The COLA increase could contribute to the long-term sustainability of Social Security, as it helps to ensure that recipients are able to maintain their standard of living.

Analyzing the Impact of the COLA Increase

The 2025 Social Security Cost-of-Living Adjustment (COLA) will affect millions of Americans who rely on Social Security benefits. Understanding how this increase will impact different benefit types and the overall program’s sustainability is crucial.

Impact on Different Benefit Types

The COLA increase will affect various Social Security benefits, including retirement, disability, and survivor benefits.

- Retirement Benefits: Retirees will see an increase in their monthly payments, providing them with more financial security. For example, a retiree receiving $1,500 per month in 2024 could expect to receive approximately $1,545 per month in 2025, assuming a 3% COLA.

- Disability Benefits: Individuals receiving disability benefits will also experience an increase in their monthly payments. This adjustment will help offset rising costs of living and ensure they can maintain their standard of living.

- Survivor Benefits: Spouses and children receiving survivor benefits will also see an increase in their payments. This adjustment will help them cope with the financial challenges of losing a loved one.

Purchasing Power of Social Security Benefits

The COLA increase aims to maintain the purchasing power of Social Security benefits by adjusting them for inflation. However, the effectiveness of this adjustment depends on the accuracy of inflation measurements and the actual cost of goods and services.

The COLA increase is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures changes in the cost of a basket of goods and services typically purchased by urban wage earners and clerical workers.

If the CPI-W accurately reflects the inflation experienced by Social Security beneficiaries, the COLA increase should effectively maintain their purchasing power. However, if the CPI-W underestimates inflation, the COLA increase may not fully compensate for rising costs, leading to a decrease in the real value of benefits.

Impact on the Long-Term Sustainability of Social Security

The COLA increase can impact the long-term sustainability of the Social Security program. While it helps beneficiaries cope with rising costs, it also increases the program’s expenses.

The Social Security program’s trust fund is projected to be depleted by 2034, meaning the program will only be able to pay out about 80% of scheduled benefits.

Higher COLA increases, while beneficial for beneficiaries, could accelerate the depletion of the trust fund, potentially leading to benefit cuts in the future. Balancing the needs of current beneficiaries with the long-term sustainability of the program is a complex challenge that requires careful consideration of various factors, including demographics, economic growth, and government policy.

Exploring the Future of Social Security

The future of Social Security is a subject of ongoing debate and analysis. The program faces significant challenges, including an aging population, rising healthcare costs, and economic uncertainty. However, there are also opportunities for reform and improvement.

Potential Future Scenarios for Social Security

The future of Social Security depends on various factors, including demographics, economic growth, and policy changes. Here are potential future scenarios:

- Scenario 1: Continued Sustainability – In this scenario, Social Security remains solvent through a combination of economic growth, modest benefit adjustments, and gradual policy changes. This scenario assumes that the economy continues to grow at a healthy rate, and policymakers make necessary adjustments to the program to ensure its long-term sustainability.

- Scenario 2: Gradual Decline – In this scenario, Social Security faces increasing financial strain due to slower economic growth, rising healthcare costs, and a lack of significant policy changes. This scenario assumes that the economy grows at a slower pace, and policymakers fail to address the program’s long-term funding challenges. Benefits could be reduced, or the retirement age could be raised to address the funding shortfall.

- Scenario 3: Significant Reform – In this scenario, policymakers implement major reforms to Social Security, such as raising the retirement age, reducing benefits, or increasing payroll taxes. This scenario assumes that policymakers are willing to make significant changes to the program to ensure its long-term sustainability. These changes could be politically challenging, but they may be necessary to address the program’s financial challenges.

Challenges and Opportunities for Social Security

The future of Social Security presents both challenges and opportunities.

Challenges

- Aging Population – The United States is experiencing an aging population, with the number of retirees growing faster than the number of workers. This demographic shift puts pressure on Social Security, as there are fewer workers paying into the system to support a growing number of retirees.

- Rising Healthcare Costs – Healthcare costs are rising faster than inflation, putting pressure on Social Security’s finances. As people live longer, they are more likely to require healthcare, increasing the program’s costs.

- Economic Uncertainty – The global economy faces various uncertainties, including trade wars, geopolitical tensions, and climate change. These uncertainties could affect economic growth and the stability of the Social Security system.

Opportunities

- Policy Reforms – Policymakers have opportunities to make changes to Social Security to ensure its long-term sustainability. These changes could include raising the retirement age, reducing benefits, or increasing payroll taxes. Policymakers could also consider expanding the program’s investment portfolio to generate higher returns.

- Technological Advancements – Technological advancements, such as artificial intelligence and automation, could lead to increased productivity and economic growth. This growth could help to offset the financial challenges facing Social Security.

- Increased Labor Force Participation – Policies that encourage increased labor force participation, such as affordable childcare and eldercare, could help to boost the number of workers contributing to Social Security.

Projected Growth of Social Security Benefits

The following table shows the projected growth of Social Security benefits over the next decade, considering different economic scenarios.

| Scenario | Average Annual Benefit Growth (2025-2035) |

|---|---|

| Optimistic (High Economic Growth) | 3.0% |

| Moderate (Moderate Economic Growth) | 2.0% |

| Pessimistic (Low Economic Growth) | 1.0% |

“The future of Social Security depends on a combination of factors, including economic growth, demographics, and policy decisions. It is essential to address the program’s long-term financial challenges to ensure its sustainability for future generations.”

The 2025 Social Security COLA increase, a figure shrouded in speculation, has been the subject of much discussion. Some whisper of a connection to the devastating impact of tropical storm Debby hurricane on the economy, while others suggest it’s simply a matter of inflation.

The truth, however, remains elusive, a secret hidden beneath layers of data and political maneuvering. The answer, like the storm itself, is both powerful and unpredictable.

The whispers around the 2025 social security cola increase are growing louder, fueled by speculation and a hint of unease. Some say it will be a lifeline, others a mere flicker in the storm. Perhaps the answer lies in the intricate carvings of a shabby chic dressing table and chair , a testament to the beauty found in the weathered and worn.

Just as the table holds its secrets, so too does the future of social security, waiting to be unveiled.